FAQ

What is KYC and why is it needed?

"Know Your Client" (abbreviated as KYC) is a rule that requires banks, exchange offices and other companies dealing with people's money to verify and identify the identity of their customers before making financial transactions.

This requirement extends to obtaining reasonably complete information about counterparties-legal entities, the nature of their business and certain business transactions for which a financial transaction is being conducted.

What do I need to do to successfully complete the KYC verification process?

To complete a successful KYC verification, you should follow these steps:

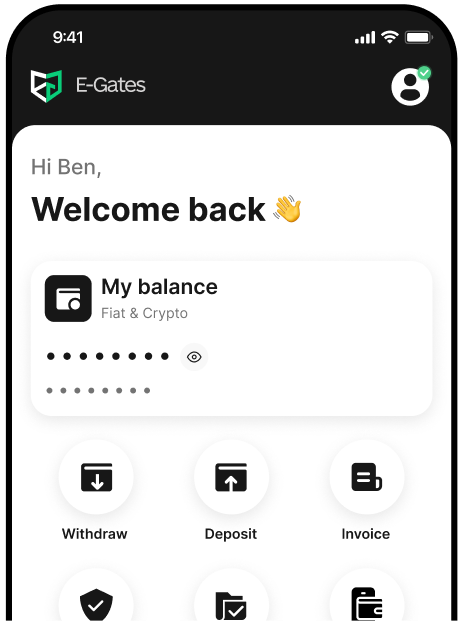

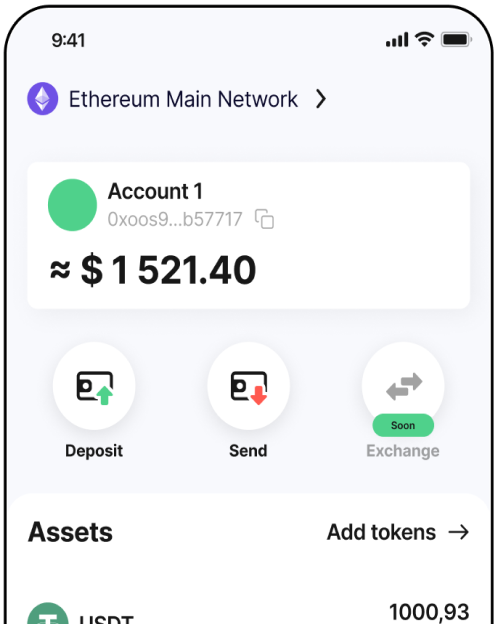

- Install the App and start verification;

- Enter the requested information about yourself;

- Upload a photo of your identity document;

- Take a selfie;

- Done! Get results in 10 minutes on average.

Why my KYC verification was declined?

A KYC verification request may be declined for various reasons. First of all, check the correctness of the entered data and the compliance of all the information provided with the data in the documents you uploaded. You can also try taking photos of documents and selfies against a plain background. If the above tips did not help you pass verification, we recommend contacting our support team: support@e-gates.io.

Can I verify KYC without logging into my account in the application?

Absolutely! Our system allows for a convenient process. To complete the KYC verification, just click the button or scan the QR code from your phone on our website's Verification page. It's a straightforward and user-friendly way to confirm your identity without any complications.